Buying a house is one of the biggest financial decisions people make in their lives. It’s also one of the most expensive purchases, as buying a home typically requires taking out a mortgage loan for hundreds of thousands of dollars. But how do people actually afford to buy houses?

The answer lies in understanding all the factors that go into securing financing for a home purchase and learning about different strategies you can use to help make it happen. From getting your finances in order and understanding mortgage loans to shopping around for competitive rates and utilizing special programs, there are many ways you can increase your chances of owning your dream home.

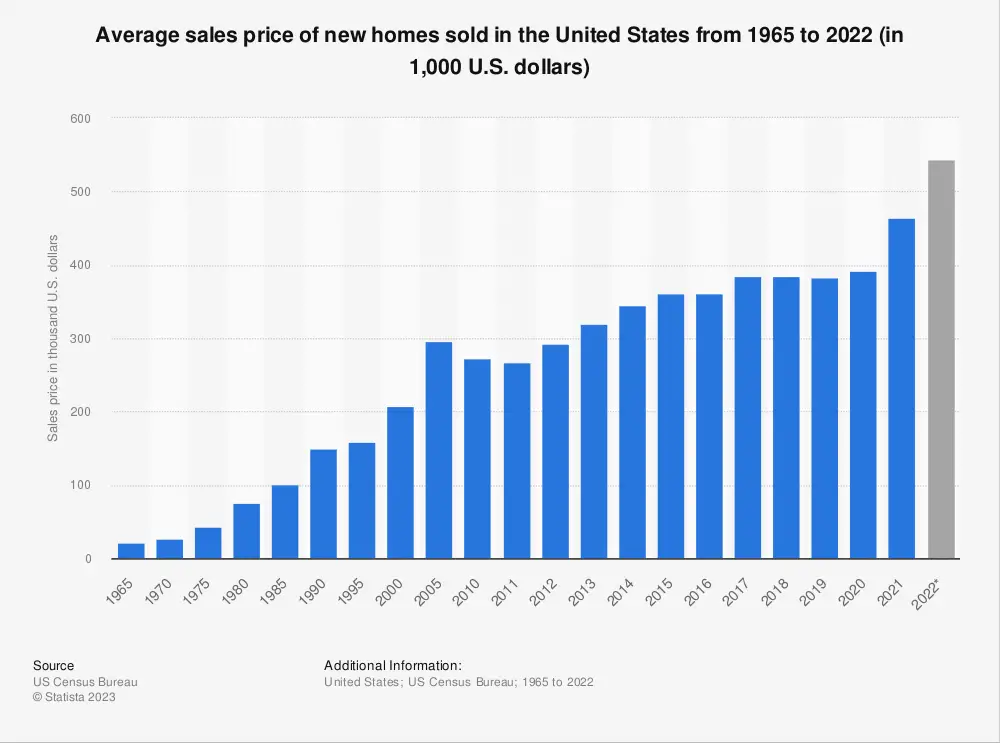

Average Cost of Homes in the US

The average cost of a home in the United States is around $220,000. This number can vary greatly depending on the location, size and age of the house. For example, homes in cities tend to be more expensive than those located in rural areas. Additionally, houses with more bedrooms or bathrooms will usually have higher price tags than smaller homes.

How People Save For A Downpayment

One of the most important decisions that aspiring homeowners make is how to save money for a down payment. The larger your initial investment, the lower your subsequent mortgage payments will be. It’s common for people to take years to save up for a house, so it’s important to have a realistic plan in place.

Live Below Your Means

If you’re looking to save for a downpayment on a home, it’s essential to recognize the importance of living frugally. This means that, in order to save money for your down payment, you should be spending less than you make. Living within your means is an essential part of saving for a house.

Debt Pay Off

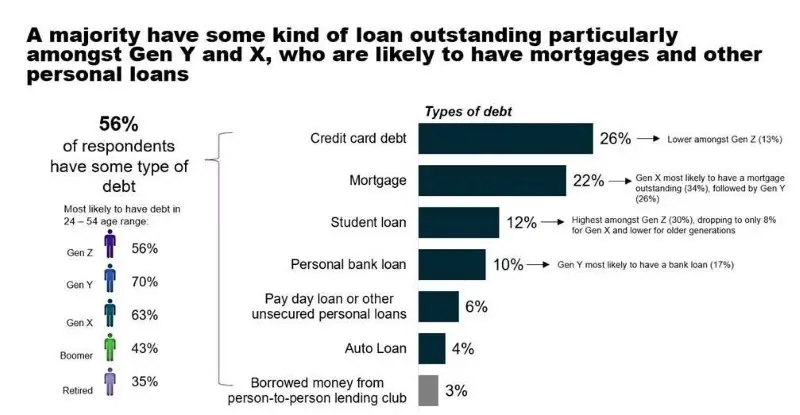

Debt pay off is an increasingly popular option among those looking to finance a house. Unlocking funds that were previously devoted to monthly payments by paying off debt can be a tremendous aid in making a down payment. Not only can paying off debt make your financial life easier, but it can also help you gain access to more competitive interest rates when applying for a home loan.

Side Jobs

Getting an additional job or side hustle is another way to afford a house. In many cases, this can be the most practical option if the original income you have doesn’t quite meet your budget needs. It could be something like driving for a ride-sharing app or working in retail part-time. This extra source of income could cover the necessary housing payments and other costs you incur from owning a home. Some people find that having two jobs allows them to pay down their mortgage faster as well. [1]

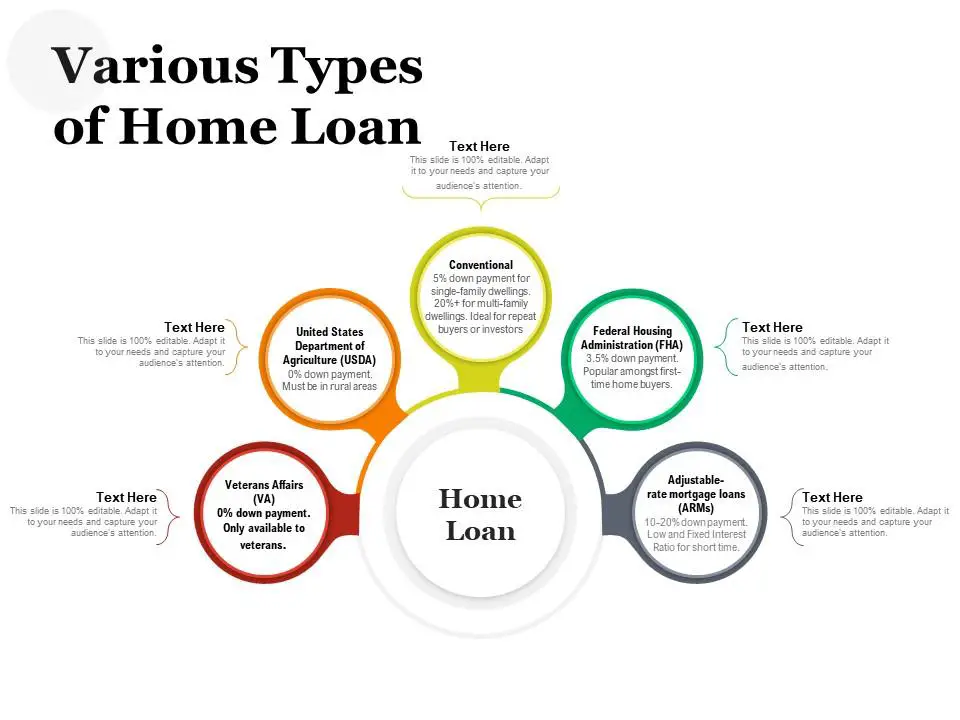

Types Of Home Loans

When it comes to purchasing a home, there are many types of loans available. From conventional mortgages to adjustable-rate (ARMs), FHA, and VA loans – there is an array of mortgage options available.

Low Income Home Loans

The federal government, particularly through the Department of Housing and Urban Development (HUD), offers low income home loans to provide assistance for those from less privileged backgrounds who wish to become homeowners. These loans generally come with more lenient eligibility requirements, lower down payment options, and more generous interest rates than conventional mortgages. Low income home loans can also be used to make improvements to an existing home or buy a newly constructed one.

Get Help For A Downpayment

One of the most significant costs when it comes to buying a home is the downpayment. This can be a daunting task for many people as the amount of money needed for a downpayment can be considerable. Fortunately, there are programs available that provide assistance with this portion of purchasing a home.

The Federal Housing Administration (FHA) offers loans, which let buyers pay as little as 3.5% of the purchase price for a downpayment. The U.S. Department of Agriculture (USDA) also has loan programs that may reduce or eliminate the cost of a down payment, depending on the buyer’s financial situation and where they live.

In addition, banks, credit unions and other lenders may offer down payment assistance programs, or even grants to help cover the costs associated with purchasing a home. Many of these programs have specific requirements that must be met in order to qualify.

Finally, there are state and local housing authorities that provide loans and grants for homeownership. These can be an invaluable source of assistance for those looking to purchase a home. [2]

What to Think About When Buying a House (by Age)

When it comes to buying a house, age is an important factor to consider. Depending on your life stage, you may have different needs and financial resources when it comes to purchasing a home.

Baby Boomers

When deciding to purchase a house, baby boomers must carefully consider the amount they can truly afford in order to avoid financial strain. Even though you may be closer to retirement age and have more financial security than other generations, it’s still important to think about potential lifestyle changes that could affect your ability to pay your mortgage. It’s also important to remember that as you get older, the cost of living may increase and your health may start to decline, leaving less disposable income for housing expenses.

Generation X

Generation X is the demographic cohort following the baby boomers and preceding the millennials. They are commonly associated with parenting, popular culture, and technology. Generation X was lucky enough to enter the world during a period of economic growth, leading them to take advantage of advantageous interest rates and rising home prices. This increased their buying power when it came to purchasing homes. Generation X was also the first generation to benefit from home loan programs such as FHA and VA loans, which made it easier for them to become homeowners.

Additionally, many Generation Xers were able to take advantage of tax credits and other incentives that allowed them to purchase homes even if they weren’t financially ready for them.

Millennials

Millennials are often considered a sub-generation within the larger Baby Boomer generation, and they have an entirely different approach to homeownership. Millennials have seen firsthand how devastating economic downturns can be for those who are over-extended on debt and invested in high-risk investments. As such, many millennials prefer to opt for renting rather than buying a house. Renting allows them the flexibility to move if their career or family circumstances change, and it also gives them the opportunity to save up for a down payment on a home that is more affordable and lower risk.

In addition, millennials often favor walking neighborhoods with plentiful amenities such as restaurants, stores, parks and other attractions. These neighborhoods tend to be more expensive, though, which means that saving up for a down payment can take longer. Furthermore, many millennials have high levels of student loan debt to contend with, which can make it harder to qualify for a mortgage or secure an affordable one.

Generation Z

It’s increasingly difficult for people of Generation Z to afford homes. The rising cost of living combined with stagnant wages has made it harder for young adults to save up for a down payment on a house without taking on more debt. Additionally, given that Gen-Zers are more likely to be burdened by student loan debt, they can find it difficult to qualify for a mortgage loan. In order to make homeownership more accessible, potential buyers are turning to other methods of financing such as rent-to-own programs and bridge loans.

Bridge loans bridge the gap between buyers and lenders by providing short-term funds to help purchase a new home before selling their current one.

Ultimately, these financing options provide Gen-Zers with more flexibility when it comes to buying a house. Additionally, government initiatives such as tax credits and down payment assistance can also help to make homeownership more affordable. [3]

You Need a Pro on Your Side

When you’re looking to purchase a home, it can be difficult to navigate the many financial complexities you’ll face along the way. Finding a knowledgeable and trustworthy real estate professional is key to ensuring that your experience is positive and that you understand all of your options. A dependable real estate agent is a worthwhile asset, as they can suggest viable financing options, elucidate the process at hand and clarify any legal documents requiring your signature.

Additionally, they can provide an expert opinion on how much a home is worth, so you don’t end up overpaying. It’s important to remember that finding the right real estate professional doesn’t just have to mean going with the listing agent – as long as they are licensed in your state, you can work with anyone you are comfortable with. [4]

FAQ

Is 10k enough to buy a house in the UK?

It depends on where you are looking to buy, as house prices vary greatly across the UK. Although 10k may not be a sufficient amount to pay for a house in its entirety, it could effectively contribute toward making an initial deposit or down payment. It is important to remember that you also need to factor in other costs such as stamp duty and solicitor’s fees.

Additionally, you will need to have access to a mortgage in order to buy a property. It may be possible to find the appropriate plan with a 10k deposit, but this can be difficult and it’s wise to seek impartial financial guidance before finalizing any decisions.

Can I afford a 500k house in the UK?

When looking to purchase a house, the biggest concern is usually how much it will cost. It’s important to consider whether or not you can afford the purchase in addition to any costs associated with maintaining and improving your home. In the UK, an average-priced 500k property could be in reach with some careful planning and budgeting.

Will Gen Z be able to afford houses?

As the cost of housing continues to rise, it’s becoming increasingly difficult for younger generations to purchase a home. Generational differences such as income level, job stability, and financial literacy are just some of the reasons why Gen Z may have a harder time affording a house compared to previous generations. One major challenge facing Gen Z is student loan debt. According to a survey by the National Association of Realtors, 83% of Gen Zers think having student loan debt hinders their ability to purchase a house. In addition to financial factors, Gen Z may also face difficulty finding homes in desirable locations due to limited availability and higher prices.

Another issue is the lack of job stability, meaning Gen Zers may not have the security to commit to a long-term home purchase. So, can Gen Z actually afford houses? It’s complicated. For some members of the Gen Z cohort, creative strategies such as house hacking, saving for a down payment, or seeking assistance from family can make it feasible to purchase their own home. However, it’s important to keep in mind all the financial and economic factors that affect the ability of Gen Zers to purchase a home.

Why is housing so unaffordable?

The cost of housing has been steadily increasing in many parts of the world. This is due to a variety of factors, such as rising wages, higher taxes on property, and limited availability of land or suitable building materials. In some cities, like Toronto and Vancouver, the market for real estate has become so competitive that it’s difficult for buyers to afford a house.

In addition, many people take out loans or mortgages to purchase homes. Mortgages can require high monthly payments and interest rates that can be difficult to pay off in the long run. Without the necessary funds for a down payment and closing costs, prospective buyers may easily become overwhelmed with debt.

Can I afford a house on 100K a year?

How much house you can afford is contingent on a few significant considerations, including your available funds for the month, the cost of living in your desired area and any down payment you possess. If your annual salary hovers around the $100K mark, you can comfortably afford a new home ranging from $200K to upwards of $400K depending on several deciding factors. For those aspiring to own a home in an area with high real estate prices, you may need to invest more of your income and make a larger down payment in order to satisfy the financial requirements. It’s essential to consider other significant costs such as taxes and insurance when deciphering whether you can afford a home.

How much should I save for my first home?

Deciding how much you should save for your first home depends on a plethora of factors such as the cost and location of the house. For a successful home purchase, it is recommended that you save at least 20% of the total cost as your down payment. It is essential to have enough savings at the ready for any closing costs and other additional expenses that come with buying a house.

Moreover, it is essential to be cognizant of the financial obligations that come with owning a home including mortgage payments, monthly bills and upkeep costs. Before committing to buying a house, make sure you are able to comfortably afford all the associated costs.

How much house can I buy if I make 40000?

The amount of house you can buy depends on several factors, such as your income and debt-to-income ratio. Generally speaking, you should look to keep your mortgage payment at or below 25% of your take-home pay. With a household income of $40,000 per year, you should aim for a home that costs no more than $200,000. To determine a comfortable and realistic budget for yourself, you should consider other monthly expenses, such as taxes, insurance premiums, and homeowners’ association fees.

Moreover, you need to take into account the importance of setting money aside for retirement and other long-term financial objectives. If you find that the mortgage payment on a home within your budget is more than 25% of your take-home pay, you may need to consider looking for a less expensive house or spending more time saving up a larger down payment. You should also look into government programs and local grants that can help cover the cost of purchasing a home. Lastly, remember that owning a home comes with more than just your monthly mortgage payment – there are other costs you should be aware of. You’ll also need to budget for maintenance and repairs, as well as improvements you may want to make over time.

How much should I save each month?

The prospect of amassing enough funds for a down payment on a home can appear intimidating, but it’s achievable with the right plan. It all depends on the size of your desired down payment and the cost of the house you’re looking at buying. Financial professionals strongly suggest setting aside a down payment of 10-20% of the total cost for your house.

How much do I need to earn to afford a 1 million house?

In order to purchase a million-dollar home, the exact compensation you need is contingent on loan interest rates, closing costs, down payment and other associated variables. Generally speaking, however, you will need an annual household income of at least $250,000 to qualify for a mortgage on a million dollar home. Lenders generally advise that your monthly mortgage payment should not exceed 28% of your gross income, in order to ensure financial stability. Your down payment also plays an integral role in how much you need to earn to afford a million dollar house.

If you take out a conventional loan, you will likely need to put down 20%. That means that for a 1 million dollar home, you’ll need $200,000 as a down payment. Furthermore, the higher your credit score is, the better your interest rate will be and the less you’ll have to pay over time. Lenders usually require that borrowers have a minimum credit score of 680 in order to qualify for a loan with reasonable terms.

What salary do you need for a 200K house in the UK?

In the UK, a salary of at least £58,000 is needed to afford a mortgage on a 200K house. This figure takes into account several factors such as interest rates and deposit requirements. It also assumes that your monthly mortgage payments are no more than 25% of your gross income.

You will need an additional 5% (or £10,000) for the deposit unless you qualify for a Help to Buy scheme, where you only need a 5% deposit. Depending on your circumstances and credit score, you may also be eligible for an unsecured loan of up to 20% of the value of the property.

When deciding on the affordability of a mortgage, lenders analyze any present debts or liabilities that you may possess to determine how much income is available for your monthly payments.

Achieving the most competitive interest rates requires you to possess a favorable credit score and provide evidence of stable, verifiable employment income over time. If you have had a change in income recently, it is important to make sure that your lender understands why this has happened and is comfortable with the stability of your current situation.

Can I get a mortgage on 25k a year in the UK?

Yes, you can get a mortgage on 25k a year in the UK. However, the amount of money you’ll be able to borrow will depend greatly on your circumstances and other factors, such as your credit score. When considering how much money to lend you, many lenders will take into account your disposable income.

This implies that the amount you bring home after various deductions, such as taxes and student loan repayments, will be taken into consideration. Your credit score is also vitally important in obtaining a mortgage on 25k a year. An excellent credit score demonstrates to lenders that you are dependable and able to fulfill any financial obligations.

Useful Video: How To Know How Much House You Can Afford

Conclusion

The answer to the question of how do people afford houses is multifaceted. Ultimately, it comes down to budgeting, financial planning, saving for a down payment and fees, researching the various financing options available, and having a good understanding of the loan terms and conditions. With careful consideration and preparation, most individuals can find an affordable home loan that works for their situation. It’s important to remember that homeownership comes with a wide range of potential rewards, including increased equity and the potential for property appreciation. By approaching the housing market with knowledge, understanding, and diligence, many people can make their dream of homeownership a reality.

References

- https://personalfinancegold.com/how-do-people-afford-houses/

- https://knowledgeeager.com/how-do-people-afford-houses/

- https://www.ramseysolutions.com/real-estate/cant-afford-housing-market

- https://houwzer.com/blog/how-do-people-afford-houses

Leave a Reply