Afterpay has become a popular way to purchase items online, and many people are wondering if they can use it to buy a house. In this article, we will answer common questions about using Afterpay to buy a house. We will also provide some useful tips for those considering this option.

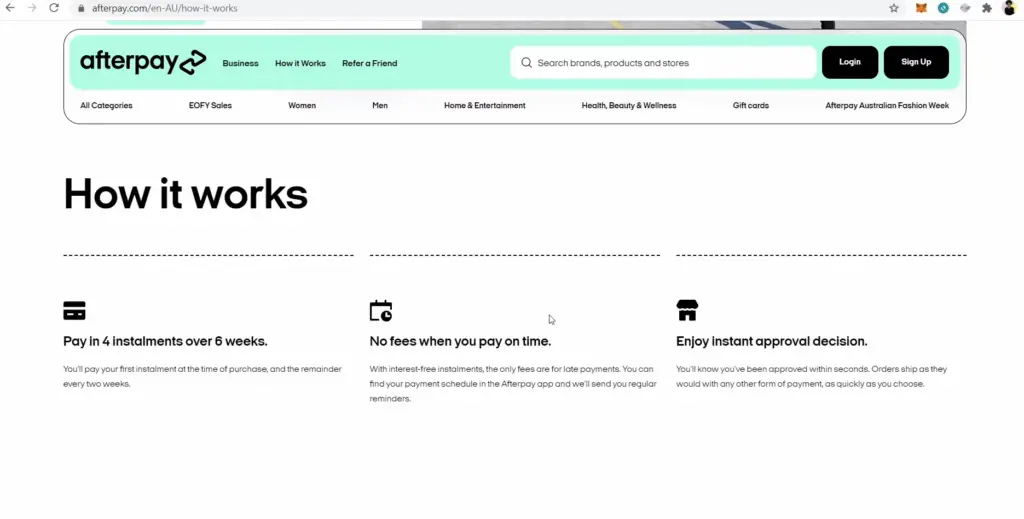

What is Afterpay?

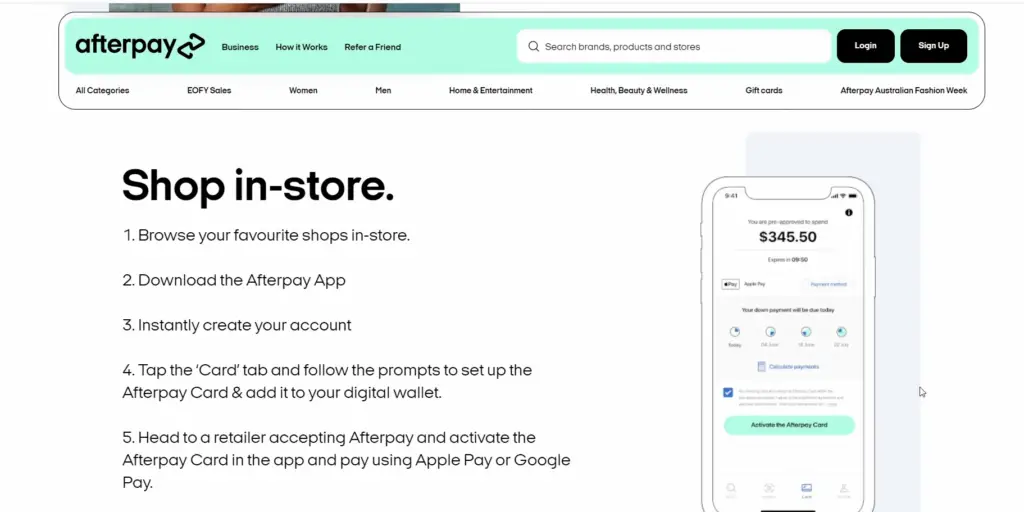

It’s becoming increasingly popular for both small and large purchases, allowing you to ‘shop now and pay later’. With Afterpay, you can make four equal payments – rather than paying for the item all at once – with each installment due every two weeks. So if you’re trying to buy a house but don’t have enough saved up yet, Afterpay could be an option worth considering.

Can You Buy a House With Afterpay?

Although it is becoming increasingly popular to pay for goods and services with Afterpay, many people are still wondering whether they can use the service to purchase a house. Unfortunately, the answer is not quite so straightforward.

In short, you cannot buy a house directly with Afterpay as it is currently set up. However, there are other methods available that may enable you to purchase your dream home even if you don’t have the money upfront.

For instance, some banks and lenders offer loans specifically designed to help borrowers purchase their first home or upgrade to a larger property. These loans often require much less of an initial down payment than traditional mortgages and may also include incentives like lower interest rates or discounts on closing costs. Additionally, some states and local governments offer first-time homebuyer programs that provide assistance with down payments or closing costs.

If you don’t have the funds to purchase a home outright but are still interested in using Afterpay, there are still options available.

In the end, whether you can buy a house with Afterpay is highly dependent on your individual circumstances. If you require more funds upfront than what you currently possess, it may be worth exploring other financing options such as loans or government programs. However, if you have the money available to purchase a house outright, Afterpay can be used for some of the other costs associated with buying a home.

No matter what your personal situation is, it’s important to remember that purchasing a house is one of the biggest financial decisions you’ll ever make and should not be taken lightly. Be sure to take your time and do your research before committing to any type of loan or payment plan so that you can find the best option for you.

Why does Buy Now, Pay Later have an impact at all?

Buy Now, Pay Later (or BNPL) has become increasingly popular over the last few years, and it’s easy to see why: It offers customers the chance to make a purchase now but pay for it later in installments. This makes buying larger items more manageable and can help people avoid debt if they have limited cash flow.

Now that this type of payment is so widely available, many people are wondering whether you can use it for even bigger purchases – like buying a house. The answer is yes – you can use Buy Now, Pay Later services when purchasing a home.

It’s important to note that this isn’t necessarily the best option for everyone – there are a few things you should consider before making the decision to use BNPL for your home purchase.

What are the Benefits of Using BNPL When Buying a House?

Using Buy Now, Pay Later services when buying a house can be beneficial in certain circumstances. For one, it allows you to spread out the cost of your new home over time instead of paying for it all at once. This can make affording a more expensive property more manageable and help take some of the financial pressure off in the short term.

Additionally, if you’re approved for an Afterpay loan (or other BNPL loan) you may receive additional money that can be used for other expenses, like moving costs or renovation projects.

What to Consider Before Using BNPL for Your House Purchase

While using Buy Now, Pay Later services when purchasing a house may have its advantages, there are also some potential downsides and risks you should consider.

For one, it’s important to remember that if you fail to make your payments on time or default on the loan altogether, it could affect your credit score negatively. Additionally, any missed payments will likely incur late fees and other penalties which could be quite costly in the long run.

Additionally, since you’ll need to pay interest on this type of loan – unlike with a traditional mortgage – your overall cost may actually be higher than if you purchased the house without BNPL.

The Impact On Property Investors

Property investors can also take advantage of Buy Now, Pay Later services when purchasing a home. This can be beneficial if you’re looking to purchase multiple properties but don’t have the upfront capital available.

However, it’s important to remember that using BNPL for your property investments may not be the best option in all circumstances and could actually end up costing more than a traditional mortgage depending on interest rates and other factors.

The Impact On Home Buyers

For home buyers, the decision to use Buy Now, Pay Later services when purchasing a house should be made carefully. While it may make affording your new home more manageable in the short term, you’ll need to make sure that you understand the full terms of your loan and are able to keep up with payments or risk damaging your credit score.

Ultimately, only you can decide whether using BNPL for your house purchase is right for you – but if done properly it can be a good option for some people.

Who Is Affected Most?

In general, those who could benefit most from using Buy Now, Pay Later services when purchasing a house are people with a limited cash flow. If you don’t have enough money saved up to pay for the entire cost of your new home upfront, this type of loan can help spread out the payments over time.

Ultimately, only you can decide whether or not using Afterpay (or another BNPL service) is right for you – but if done properly it can be beneficial in certain circumstances. [1]

Why do lenders consider Afterpay in your home loan application?

When it comes to lenders considering Afterpay in your home loan application, they want to know that you are able to make regular payments on time. This shows them that you are responsible and capable of managing your finances. Afterpay is a great way to demonstrate these qualities as it allows you to budget for purchases over an extended period of time, meaning that if something unexpected arises, there’s less likelihood of defaulting on the loan payments in the future.

Another factor that lenders consider when assessing your application is whether or not Afterpay can be used in place of a deposit. Lenders will look at this as a sign of financial commitment from the borrower and may take this into account when making their decision. It also allows borrowers who may not be able to afford a larger deposit upfront the chance to buy their dream home sooner than they might have otherwise been able.

Moreover, when assessing your application for a loan, lenders may evaluate how long you have been using Afterpay. Generally, if you have been using Afterpay for more than 6 months, this can give lenders greater confidence in your ability to make regular payments on time and manage your finances responsibly.

Overall, lenders view Afterpay as a positive indicator of financial responsibility that can help strengthen an individual’s loan application. While it’s not guaranteed to get you approved for a home loan, having a strong history of making timely payments with Afterpay may improve your chances of being accepted.

What is the role of Afterpay in your home loan application?

Afterpay can play an important role in your home loan application. If you use Afterpay to purchase items such as furniture and appliances for your home, it will be included on your credit report as a positive account that demonstrates responsibility for the debt. This can help boost your credit score and make you more attractive to potential lenders when applying for a mortgage loan. Additionally, if you have been using Afterpay consistently over time and paying off the amounts due each month, this can demonstrate to mortgage lenders that you are financially responsible and could help give them more confidence in approving your home loan application.

While Afterpay may look like a great option for financing your mortgage loan, it’s essential to remember that the money you owe with these services will be used when calculating your credit score. Therefore, it is important to use Afterpay responsibly or else you could end up negatively affecting your overall financial standing. This means that if you have a large amount of money owed through Afterpay, it could still negatively impact your credit score and potentially harm your chances of being approved for a mortgage loan.

Finally, while Afterpay can definitely help you build up a positive credit history over time and improve your chances of getting approved for a mortgage loan, it’s important to remember that the main factor lenders consider when assessing home loan applications is repayment capacity. Your repayment capacity will ultimately determine whether or not you are eligible for a mortgage loan and how much money the lender is willing to lend you. So it’s important to ensure that your income and employment status are sufficient for the loan you’re applying for, as this will be the deciding factor for lenders.

Debts may impact your credit history

When you use Afterpay to purchase items, the amount of money owed will show up on your credit report as a debt. This means that lenders may factor in this debt when assessing your eligibility for a loan. It’s important to keep in mind that larger debts or a history of late payments could negatively impact your credit score and make you less attractive to potential lenders when applying for a mortgage loan.

Therefore, it is important to ensure that you are able to repay any outstanding amounts due with Afterpay before applying for a mortgage loan. Additionally, if possible, try to make all payments on time each month as this will help build up a positive credit history which can be beneficial when applying for loans.

Finally, it’s important to keep in mind that your overall financial situation will be taken into account when applying for a loan.

Lenders consider all your expenses

When it comes to applying for a mortgage loan, lenders will take into account all of your living expenses, not just those related to Afterpay. This means that they will factor in any other debts or financial obligations you have such as car payments, credit card debt, student loans or any other expenses when assessing your eligibility. It’s important to keep this in mind when applying for a loan as these additional costs could affect the amount of money you are able to borrow and/or be approved for.

Additionally, if you plan on using Afterpay while also taking out a mortgage loan, make sure you do some careful budgeting beforehand to ensure that you can afford the additional expense without putting too much strain on your finances. Finally, make sure to shop around for the best deal when it comes to mortgage loans as lenders will have different requirements and interest rates. [2]

It may look like you can’t manage your money and expenses

In fact, it can be quite beneficial for those who are ready to commit to the payment plan and have an understanding of their finances before entering into the purchase.

The biggest benefit of using Afterpay to purchase a home is the ability to spread out payments over time and manage your budget better. This option can provide some relief as you’ll know exactly how much money needs to be allocated each month for mortgage repayments. It also doesn’t require you to pay interest like other forms of financing – which could save you thousands in the long-run!

However, there are a few things to consider before making this decision. Firstly, your credit score should be taken into account to determine whether or not you will qualify for the loan. Additionally, any existing debt must also be considered and managed. Both of these factors are important when determining whether an Afterpay home purchase is right for you.

It’s also essential that you have a thorough understanding of the terms and conditions associated with the purchase before signing on the dotted line. This includes understanding the fees and costs associated with each payment plan as well as any additional costs such as real estate taxes, insurance premiums, etc.

Finally, remember that this type of financing isn’t for everyone – so make sure to give careful consideration before deciding if this is the right path for you.

FAQ

Does Afterpay stop you getting a mortgage?

No. Afterpay won’t stop you from getting a mortgage as long as you have the necessary credit score, deposit and income required by your lender. However, lenders may take into account your financial history when assessing any loan application and this could include your Afterpay payments. That being said, if you are responsible with using Afterpay and making your payments on time, it should not affect your ability to get a mortgage. [3]

Does Afterpay stop you from getting a home loan?

No, Afterpay won’t stop you from getting a home loan. However, it is important to understand that having an Afterpay account can affect your credit score, especially if you’re not paying off the balance on time. Your credit score will be taken into consideration when applying for a home loan and lenders are likely to take a closer look at how responsibly you manage your Afterpay payments before they agree to lend you money.

It is also important to keep in mind that lenders may want to know where the money came from in order to purchase the house with Afterpay. You will need proof that you have sufficient funds such as pay slips or bank statements so make sure you have these ready ahead of time.

Finally, it is important to note that Afterpay does not offer a loan for buying a house. This means you will need to apply for a home loan elsewhere to finance your purchase.

Is there a downside to using Afterpay?

Using Afterpay to purchase a home can seem like an easy and convenient way to buy a house. However, there are some potential drawbacks that you should consider before you make the decision to use this payment option.

First of all, using Afterpay may require you to pay additional fees. Depending on how much money you put down or where you’re located, the costs could be significant and could add up quickly over time. In addition, these fees may not always be clearly outlined in your agreement so it’s important to ask questions about them when speaking with your lender or real estate agent.

It’s also important to remember that Afterpay is still basically a loan – even though it’s not a traditional one. You’ll need to pay back the money you owe over time and there may be additional interest associated with late payments. This could result in a larger financial burden than if you had paid cash upfront, so it’s important to consider your overall budget and determine whether paying off an Afterpay loan is feasible for you before signing any commitments.

Finally, using Afterpay could also have an effect on your credit score. Because this form of payment can appear as a loan on your report, depending on how well you manage the payment plan, it could potentially lower your credit rating – making it difficult to apply for other loans or mortgages down the road.

For these reasons, it’s important that you carefully consider all of the potential pros and cons before deciding to use Afterpay to purchase a home.

At the end of the day, purchasing a home is a big commitment – so it’s important that you feel confident about your payment plan and understand any risks associated with using Afterpay. Take some time to research the available options and explore which one best fits your needs. With careful consideration, you can make an educated decision that could help you achieve your dream of homeownership!

How many loans can you have with Afterpay?

When you sign up for Afterpay, you can have up to four active loans at any one time. This means that if you are looking to purchase a house through Afterpay, it’s important to ensure you don’t already have four other loans open with the service.

If you do have more than four active loans, you will need to pay off some of your current existing balances before applying for a new loan. After all, taking out too many loans at once can be risky and may affect your credit score.

To help manage multiple loans better, Afterpay also offers their budgeting tool which helps users track their spending and stay within budget limits. It’s free to use and can be found in the ‘Manage My Account’ section of their website. [4]

Hopefully, this has given you an overview of what to consider if you’re planning to purchase a house with Afterpay.

Useful Video: How To Use Afterpay Buy Now Pay Later Full Tutorial

Conclusion

The answer to the question “Can You Buy a House With Afterpay?” is complex. While it may be possible for some individuals, the process can be difficult and requires thorough research, sound financial planning, and savvy real estate investing. As with any major purchase decision, doing your due diligence is important before making any decisions. Make sure you are fully aware of all associated costs and that you understand how much money you will need to pay upfront as well as in future payments. Finally, consult with an experienced real estate agent or attorney if needed – they can help guide you through the process and ensure your best interests are taken into account.

Overall, buying a house with Afterpay can be done – but only with the right steps and savvy. With the right approach, you can use Afterpay to help make a major purchase like buying a house even more manageable. Good luck!

References

- https://www.opespartners.co.nz/mortgage/afterpay

- https://www.ratecity.com.au/home-loans/articles/impact-afterpay-home-loan-application

- https://help.afterpay.com/hc/en-au/articles/900005359763-Will-using-Afterpay-affect-me-being-able-to-get-a-home-loan-

- https://www.thebalancemoney.com/what-is-afterpay-5185062

Leave a Reply